Off the keyboard of Steve from Virginia

Follow us on Twitter @doomstead666

Friend us on Facebook

Published on Economic Undertow on March 31, 2015

Discuss this article at the Economics Table inside the Diner

There was an eye-catching article in the Washington Post the other day:

Meet the 26-year-old who’s taking on Thomas Piketty’s ominous warnings about inequality,Jim TankersleyIt was 2:45 a.m. on a Thursday last April. Matthew Rognlie was still awake, like a lot of graduate students. He had just finished typing 459 words and a few equations. They totaled six paragraphs, which he posted to the comments section of a popular economics blog.Rognlie’s comment on the blog Marginal Revolution was a response to the provocative argument laid out by the French economist Thomas Piketty in his bestselling book on wealth inequality, “Capital in the Twenty-First Century.”Piketty had worried in his book that wealth inequality (surplus) could soon explode at such a velocity that it would continue to widen essentially on autopilot. Wealthy people would accumulate more capital in the form of stocks, real estate and other assets, would continue to earn high returns on them, and then would have more capital to invest. As more and more money became concentrated among the wealthy, less and less would be available to workers. The book turned Piketty into an international celebrity.Rognlie, however, wrote in his blog post that the French economist’s argument “misses a subtle but absolutely crucial point.” Piketty, he said, might have got the pattern in reverse. Instead of the returns to capital increasing in perpetuity, Rognlie said, they might be poised to decline.

This is from Rognlie’s comments on Tyler Cowen’s Marginal Revolution blog:

Krugman correctly highlights the importance of the elasticity of substitution between capital and labor, but like everyone else (including, apparently, Piketty himself) he misses a subtle but absolutely crucial point.

Elasticity of substitution measures the changing relationship between ‘production’ inputs ‘K’ (capital, in the conventional sense) and ‘L’ (labor), it is a component of neo-classical economics.

When economists discuss this elasticity, they generally do so in the context of a gross production function (NOT net of depreciation). In this setting, the elasticity of substitution gives the relationship between the capital-output ratio K/Y and the user cost of capital, which is r+∂, the sum of the relevant real rate of return and the depreciation rate. For instance, if this elasticity is 1.5 and r+∂ decreases by a factor of 2, then (moving along the demand curve) K/Y will increase by a factor of 21.5 = 2.8.Piketty, on the other hand, uses only net concepts, as they are relevant for understanding net income. When he talks about the critical importance of an elasticity of substitution greater than one, he means an elasticity of substitution in the NET production function. This is a very different concept. In particular, this elasticity gives us the relationship between the capital-output ratio K/Y and the real rate of return r, rather than the full user cost r+∂. This elasticity is lower, by a fraction of r/(r+∂), than the relevant elasticity in the gross production function.This is no mere quibble. For the US capital stock, the average depreciation rate is a little above ∂=5%. Suppose that we take Piketty’s starting point of r=5%. Then r/(r+∂) = 1/2, and the net production function elasticities that matter to Piketty’s argument are only 1/2 of the corresponding elasticities for the gross production function!

From Rognlie’s MIT paper:

Capital in the Twenty-First Century (Piketty) is a work of remarkable scope and influence, with a sweeping new view of income, wealth, and inequality. It builds on a singular trove of data assembled by Piketty and coauthors, and it is sure to be a centerpiece of the debate for years to come. Although the book is widely recognized for its empirical contributions, it also uses this data to construct a distinctive theory about the trajectory of the wealth and income distribution.

Rognlie’s criticism is similar in form to Chris Giles’ picking apart of Piketty in FT a few months previous. Despite claims to the contrary; it is also similar to criticism of Reinhart and Rogoff by Herndon, Ash and Pollin. In these other instances there are faults found with the first authors’ calculations or data. Rognlie argues Piketty substituted a net function for gross; his remarks are giving him with his fifteen minutes of fame within macroeconomic circles, it can be said he is riding on Piketty’s coattails (as Economic Undertow is right now riding on Rognlie’s).

One of the main themes in Piketty (2014) is the gap r – g between the real return r on capital and the real growth rate g of the economy. This gap, for instance, gives the rate at which a wealthy dynasty can withdraw capital income for consumption purposes with- out decreasing its wealth relative to the size of the economy. More generally, when r – g is higher, “old” accumulations of wealth become more important relative to “new” ones. Higher r – g generally implies that the power law tail of the wealth distribution has a smaller exponent … so that there is more inequality of wealth at the top, and extreme levels are more likely. Many readers take the dynamics of r – g to be the central theme of the book.One of its central themes is a story of capital accumulation. In Piketty’s framework, slower growth will produce a rise in the ratio of capital to income. This, in turn, will bring about an expansion in capital’s share of income. Meanwhile, as the growth rate g dwindles and the return on capital r holds relatively steady, the gap r – g will expand, allowing existing accumulations of wealth to grow more rapidly relative to the economy as a whole. This will aggravate inequality in the wealth distribution. In short, a key message of Capital in the Twenty-First Century is that capital’s role in the economy will grow in the twenty-first century.As Piketty readily acknowledges, diminishing returns may be problematic for this thesis. If the return on capital falls quickly enough when more capital is accumulated, capital’s share of income will fall rather than rise—so that even as the balance sheets of capital owners expand, their claim on aggregate output will shrink. Furthermore, with a sufficient decline in r (returns), as g (economic growth) falls the gap r – g will narrow as well. But Piketty argues that diminishing returns, although undoubtedly present, are unlikely to be so strong; this view is offered in additional depth in a companion journal article, Piketty and Zucman (2013).This note articulates the opposite view: most evidence suggests diminishing returns powerful enough that further capital accumulation will cause a decline in net capital in- come, rather than an expansion. If, following Piketty’s model of savings, a decline in g causes an expansion in the long-term capital stock, both the net capital share of income and r – g are likely to decline. These conclusions are not definite -— there are many obstacles to empirical certainty here —- but they do counsel skepticism about Piketty’s central outlook.In Section 2, I discuss the economic concept central to diminishing returns, the elasticity of substitution between capital and labor …When this elasticity is greater than one, a higher capital/income ratio is associated with a higher share of capital income; when the elasticity is less than one, the opposite is true. A crucial detail is whether this elasticity is defined in gross or net terms; net subtracts depreciation from income, while gross does not. Although (Piketty and Zucman) rightly affirm that net concepts are more relevant for an analysis of inequality, they do not cover the distinction between net and gross elasticities. This is problematic, because net elasticities are mechanically much lower than gross ones, and the relevant empirical literature uses gross concepts. The vast majority of estimates in this literature, in fact, imply net elasticities less than 1 … well below the levels needed by Piketty.

Piketty’s problem is not in his calculations but his “story of capital accumulation,” that, “slower growth will produce a rise in the ratio of capital to income. This, in turn, will bring about an expansion in capital’s share of income.” Maybe it will and maybe it won’t: a quick glance out the empirical window suggests the tycoons’ share of consumer excess is expanding relative to that of the labor force: Rognlie’s coattails appear to be hovering over shaky ground.

More importantly, it is unclear what exactly is being accumulated and what is being substituted for. Is capital itself being accumulated or (worthless) claims against it? Is equipment being substituted for labor or is it something else? Piketty errs when he suggests that surpluses can expand without limit. All conventional economists are in error when they suggest that the expanding money- or material claims against capital are indistinguishable from capital, itself.

Given Piketty’s assumption that K/Ynet = s/g with fixed s, it appears virtually impossible to generate a substantial increase in r – g in response to a decline in g. For empirically plausible values of the elasticity (about 1), the diminishing returns induced by higher K/Ynet cause r to drop by at least as much as g.For empirically plausible values of the elasticity (about 1), the diminishing returns induced by higher K/Ynet cause r to drop by at least as much as g … except within the Debtonomy where absolutely none of this matters! If a firm is fashionable/survivable then it borrows. Organic returns are irrelevant. What matters is the willingness of lenders to ignore system insolvency and add to the growing mountain of private- and public sector debt, to subsidize chic firms by way of their marginally-(un)employed customers.

Peak Economist

It can be said that we are now at ‘Peak Everything': complexity, credit, water, farmland, phosphorus and other strategic minerals, fisheries … certainly peak oil. The certain evidence of peak oil is all the media babble regarding a production glut. After all, how would a peak appear except as the prospect of drowning in too much oil.

At any peak there is nowhere to go but down: Western decline comes across so far as being remarkably ordinary. No doubt, the reason for this is our willingness to do anything to avoid a recession including slowly murdering our grandchildren. What James Howard Kunstler calls ‘the Long Emergency’ turns out to be a diffuse series of quiet tragedies en miniature: business failures and jobs permanently lost, drug addiction, homes surrendered to foreclosure, towns and shopping centers abandoned, infrastructure decay, insolvency, crop failures, drought and emptying reservoirs … There is little drama to the post-modern Empire of Less we currently inhabit; it has crept upon us while we were sleeping.

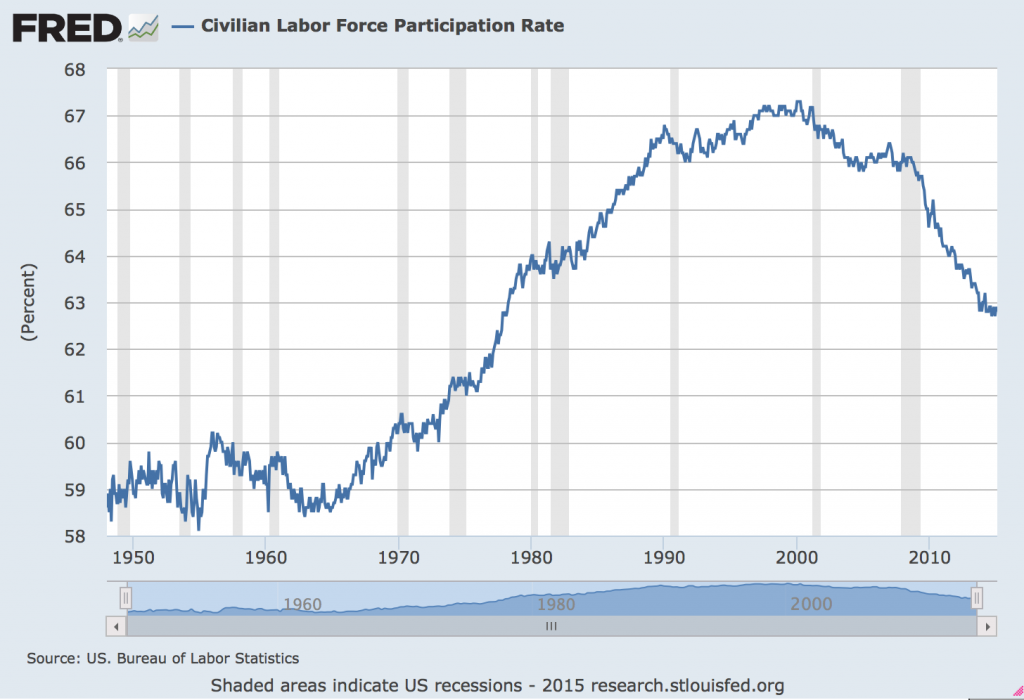

Figure 1: Elasticity of substitution in action: US labor force participation, chart by St. Louis Fed: US labor participation is unchanged since 1977 despite the massive increase in the actual US workforce occurring within that nearly- 40 year interval. Note the participation peak occurred just as computerization began to penetrate the economy, allowing the discharge of millions of clerks, materials handlers, machinists, receptionists, printers and supervisors. The outcome is a customer shortage: the inability of industry to find folks both in the US and around the world with the means to afford anything other than basic necessities. As managers reduce headcount and wage rates they are able boost businesses bottom line over the immediate term; the longer-term outcome is steady depreciation of (the worth of) labor (relative to machine output). The underemployed are forced to increase their borrowing even as fewer among them are able repay.

The ‘capital’ accumulation narrative is as old as civilization itself:

for whatsoever a man soweth, that shall he also reap,

— Galatians 6:7

An entrepreneur produces (soweths) then ‘sells’ goods and services to its customers (reaps). The firm ‘profits’ when revenue (returns from sales) exceed expenditures (costs) including those for capital (K) + labor (L). Depreciable ‘capital’ has come to mean real estate and physical infrastructure, goodwill and equipment; these things are the ‘means of production’. Given enough ‘sales’ and ‘profits’ the firm owner accumulates more of this ‘capital'; he is ‘wealthy’ in that he is possessed of less inequality than his labor force. When the firm meets its own costs by way of sales to labor, it is considered ‘productive’, it’s gains are ‘sustainable’. With time, owners obtain more profits from productive enterprises; family fortunes rise even when the overall economy slows. This is a nice story with a ‘feel good’ ending … “They profited happily ever after.”

Exit Galatians, enter industrialization: ‘sales’, ‘profits’ and ‘sustainability’ are myths emptied of any real meaning, veneers over monstrous debtonomics. Slo-mo accumulation has been relegated to the quaint micro-economy of artisans with hand tools. The shift-over occurred centuries ago: Adam Smith described the industrial process shortly after Newcomen in the mid- eighteenth century in ‘Wealth of Nations’, (from Diderot):

”One man draws out the wire, another straights it, a third cuts it, a fourth points it, a fifth grinds it at the top for receiving the head; to make the head requires two or three distinct operations; to put it on, is a peculiar business, to whiten the pins is another; it is even a trade by itself to put them into the paper; and the important business of making a pin is, in this manner, divided into about eighteen distinct operations, which, in some manufactories, are all performed by distinct hands, though in others the same man will sometimes perform two or three of them. I have seen a small manufactory of this kind where ten men only were employed, and where some of them consequently performed two or three distinct operations. But though they were very poor, and therefore but indifferently accommodated with the necessary machinery, they could, when they exerted themselves, make among them about twelve pounds of pins in a day. There are in a pound upwards of four thousand pins of a middling size. Those ten persons, therefore, could make among them upwards of forty-eight thousand pins in a day. Each person, therefore, making a tenth part of forty-eight thousand pins, might be considered as making four thousand eight hundred pins in a day.”

The pin making process; yea, but not all! Smith leaves out the debt! Factory building(s), the ground (within costly metropolitan districts), the machines, prime movers, labor force training, management and all-important marketing must be bought and paid for in advance of making the first pin! Each pin machine is itself the product of its own expensive factoria and their fleets of machines, their machines and the machines’ machines’ machines … all must be paid for in advance of that first pin … which on its own costs tens of millions of pounds! Relative to the enterprise — making and handfuls of tiny pieces of pointed wire with but one purpose — the life cycle costs are stupendous. Every component offers the potential for non-trivial losses, each of which must be met with borrowed funds. So too the profits for the manufacturers and his lenders; pins cannot be sold or profits gained until they are first in hand, marketable to customers who can make use of them. Smith simply omits all of this: it’s unpleasant, it doesn’t fit his quasi-Biblical narrative; it suggests dependence upon conniving shylocks and ankle-breaking overseers: that ‘progress’ is material fraud and abuse rather than an inevitable force of provident nature and her invisible guiding hand.

Because the multiple, competitive firms vomit pins by the freight-car load, customers by necessity are also firms: mega-pin manufacturing becomes a component of much larger downstream machine processes … all of which require loans. To retire the manufacturers’ debts the end users must have the desire (demand) and means (consumption) to pay too much for pins. They must borrow more than the manufacturers in aggregate … or else. If they cannot, (or refuse) the firms are hanged by their own borrowed rope, then the creditors themselves are likewise ruined:

“Every banker knows that if he has to prove that he is worthy of credit, however good may be his arguments, in fact his credit is gone … ”

— Walter Bagehot

The wider-scale the processes, the greater need for (debt x borrowers). Without debt, without the infrastructure of organic credit enabling the processes in their entirety there would be only hand-drawn pins made by silversmiths’ apprentices gained by way of trade or hard currency; not much Wealth of nations Tycoons, either.

Obviously, managers, ‘investors’ and factory owners are paid up-front with borrowed funds along with the machinery. Within debtonomics, firms are not productive, they don’t have to be. Instead, they are over-priced collateral (with fanciful ‘utility’) every- and all returns are borrowed, profits are artificial (fraudulent), enterprise is sustained only as long as the firms themselves or their customers can borrow and refinance maturing debts.

Because firms are not productive, because they borrow their returns, the ℇ elasticity of substitution … the relationship between the capital-output ratio K/Y and the user cost of capital, which is r+∂ … the sum of the real rate of return plus the depreciation rate … all of these are irrelevant! What matters is access to a willing lender. In contrast to the mysterious and exotic clockwork of macro-econometrics, debtonomy is a bludgeon to the head; simple enough for a gangster, politician, banker or stock swindler to understand. The debtonomy’s functions are entirely expedient, almost magically so. All dilemmas are resolved by throwing more borrowed money at them … along with bombs and billy clubs. As long as economic agents have access to ‘fuel': lending capacity and capital to waste, the debtonomy will expand consuming every available resource until the enterprise collapses under its own weight.

Within the debtonomy: businesses borrow because they can … they borrow very large amounts because they can. A ‘good’ business … can borrow … because it is fashionable … and for no other reason. The businesses’ customers must borrow even larger amounts in order to retire the firm’s loans-plus-interest. In debtonomics, this is said to be a ‘firm borrowing against the accounts of its customers- or against that of the state’. There is really no difference between the two: borrowings against the state are nothing more than involuntary loans by the same customers’ children.

Instead of capital being substituted for labor, debt is substituted for returns. The real costs of capital (resource inputs + externalities) are misstated in order for firms to ‘fake’ profitability: progress turns out to be faulty accounting. Because firms are not productive, debt must increase in order for business activity to expand so as to meet debt service costs. The debtonomy collapses when sufficient marginal borrowing capacity is dedicated to debt service (Minsky Moment).

Economic activity requires material- plus energy needed to do ‘work': to move- and transform objects, to heat and forcibly cool them. As such, all activities are subject to fundamental, thermodynamic laws: what matters on our planetary endeavors are energy- and material throughput. The economy is a component of the natural environment; the constraints of nature make accumulation of surpluses difficult and slow. Like firms, the wealthy become so by borrowing large amounts of money then compelling others by force or trickery to repay the resulting debts. Any needed work is done at its own pace after the fact of enrichment. Repayment of the rich man’s loan takes as long as necessary or never completed. The work-process becomes collateral for still more loans; the longer the repayment term the greater the yield at interest, etc.

Industrial economies intend to manage diminished returns: the ‘First Law’ of economics: that the costs associated with any surplus increase along with it until at some point the costs exceed what the surplus is worth. Surpluses, by themselves, are the product of industry; they can be any tangible thing such as pins, machines, tycoon’s money or ‘wealth': gold, fuel, food, material even livestock, cars, coal, water, cigarettes; anything. As surpluses expand so do costs; agents shift these costs onto third parties, using them as ‘cost sinks’. As Rognlie observes, “the economic concept central to diminishing returns, the elasticity of substitution between capital and labor” is self-defeating.

Within conventional economics, tycoons are lenders (investors) who gain an incremental, residual returns on ‘profitable’ business enterprises: capital accumulation. Within debtonomics, tycoons are borrowers bent on outlasting their own firms, short-sellers offering vaporware ‘innovations’ when they aren’t front-running the stock exchanges.

Within the debtonomy, economists and policy makers are actors reading from scripts: as with all else in our culture, economists are products of fashion. In keeping with the expedient nature of debtonomics, economists obtain their speaking roles because they conform to expectations created by marketing managers and commercial artists. Conformity includes how managers look, dress, speak, where certified and whom they know; where they live and work and how they travel.

Within debtonomics, non-renewable resources are capital: the foundation of all productive activities. The factories and shops, fixtures and infrastructure that conventional economists consider as such are actually (tangible) claims against capital; money and debt are intangible claims. This is because factories, money, etc. produce absolutely nothing by themselves, they require resource capital to extract, process and transform … to send to the landfill or pump into the atmosphere as waste. Within the debtonomy, resource- wasting processes (claims) are collateral; capital itself cannot be collateral because it is destroyed by way of its ‘use’. Instead of becoming more wealthy as we toil, we steadily reduce ourselves to ruin: as we destroy our capital we are destroying our purchasing power at the same time.

Just as consumption can never exceed available supply, purchasing power can never exceed the resource capital that remains to be purchased. Industrial wealth is a spurious claim against capital: when it is exhausted we are bankrupt regardless of how much ‘wealth’- or money-claims workers or their tycoon overlords possess. In this way the decline in purchasing power is the result of resource mismanagement, it is also a cause of mismanagement: the process feeds upon itself (deflation).

Within convention, the economy is a set of interconnected abstract functions that can be ordered mathematically. Its is offered as a natural process (invisible hands) that can be parsed scientifically the same way as chemical reactions. These functions only only vaguely relate to the real economy, they are friction- and cost free assumptions and/or simplifications. There are no ‘controls’ or alternative economies that can be made use of in comparison. Economic models are built using statistics sourced from agencies that are captured by business interests or possessed of partisan political agendas. This is also self-amplifying as the partisan agendas promote increased capital extraction and waste. That these agencies routinely ‘err’ (lie) means that most analysis is without proper empirical foundation, that a lot of material factors are left out or wished away, resulting calculations are practically worthless.

Criminality is a foundational component of industrial capitalism. Economics tends to ignore this activity as it does not conform to the enterprise’ anodyne worldview. Conventional economics becomes an unwitting enabler- accessory to criminal activities on the largest scale. Whereas bilking or manipulating others to repay your obligations is theft, doing so on a world-wide scale is served up as ‘progress’.

Economists could do useful things like invent ‘money’ that is difficult to steal. Instead, economic theorizing repeatedly flops in the real world. Economists cannot predict recessions or extreme price movements, they cannot explain recessions after they occur. Greek economist/Finance Minister Yanis Varoufakis works hard to gain a motorist-friendly bailout from German banks: he’s a post-Keynesian expert but painfully ineffective in the real world. Varoufakis cannot command capital to appear, he has near- zero leverage over other European countries’ finance ministers, who are sock puppets of criminal finance … as is the Greek establishment. The Greeks can gain loans by surrendering to the criminals but not on anything approaching Varoufakis’ terms => damage to Greek government’s credibility. The next step is loss of confidence => (ongoing) bank run => EU credit freeze => Government failure => default => Varoufakis being replaced with another hapless economist.

The outcome of this process is Greece, de-industrialized. No loans = no industry. Despite what economists insist, firms cannot pay their own way; they are reductive rather than productive. That this is so is self-evident: if any firm could retire its own debts it would have done so already. There would be no debts; the firm would retire its own then those of the other firms, it would then make everyone rich. Instead, such a firm is thermodynamically impossible, a perpetual motion machine. In place of general prosperity the world is prostrate under a mountain of debts and useless junk; monuments to both industrialization and self-delusion

Economists also seem not to grasp that collapse in Greece or elsewhere is permanent. Industrialized capital extraction and waste-making leaves insufficient resources with which to recover.

Redistribution cannot solve anything because debt-surplus costs cannot eliminated only shifted. Aggregated industrial costs are greater than the worth of the entire economy, even as purchasing power evaporates. Workers cannot accumulate surpluses on their own because their consumption speeds their funds toward the bankers.

The first step away from calamity must include jettisoning the myths upon which our economic (mis)understandings are built. The economy is a criminal enterprise. Economists need to wake up and smell the coffee. There are no invisible hands or divine providence … only fraud. This is no game, there is no one or nothing to bail us out. Our economy does not pay for itself, there is no such thing as ‘capitalism’ unless that means pillaging. Our counterparty is Nature, she is much more powerful than we are … and does not have our interests.

The second step is to conserve our capital it must come under the stewardship of those who would husband it for the greatest (future) returns. We either conserve voluntarily or it is forced upon us by events.

The third step is to to render the elasticity of substitution … of debt for organic returns to zero. If nothing else it would end the tyranny of criminal bankers.

“The ideas of economists and political philosophers, both when they are right and when they are wrong are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually slaves of some defunct economist.”-― John Maynard Keynes